The Subplot

The Subplot | How war could change the Northern property scene

Welcome to The Subplot, your regular slice of commentary on the business and property market from across the North of England and North Wales.

THIS WEEK

- Tanks on the lawn: how Vladimir Putin could change the armed forces’ land and property needs in the North

- Elevator pitch: your weekly rundown of what is going up, and what is heading the other way

TANKS ON YOUR LAWN

What the army wants, the army gets

For the first time in a generation, there’s the risk of a war with Russia. The direct land and property needs of the forces – and the spin-offs for the private sector – could be felt in the Northern office and warehouse sectors.

The Danish defence minister says we’re between three and five years out from a Russian attack on NATO; top generals – presumably with a nod from the government – are talking up the chances of conscription; and Putin, having (probably) finished off his only serious rival in an Arctic Circle penal colony late last week, looks as mad as ever. Not happy times.

On the face of it, this is the cue for a timely surge in defence spending, and with it a raft of spin-offs for the regional economy. The property business – a major consumer of ex-Ministry of Defence land, and a potential provider of new facilities for the armed forces and their suppliers – will be in the front line. How will it play out?

The big numbers

First, the context. The MOD has an annual budget of about £53bn. This will probably rise: Prime Minister Rishi Sunak says he wants UK defence spending to grow from 2% of GDP to 2.5% but he hasn’t said when, and we don’t know what Keir Starmer thinks. So don’t hold your breath.

In the meantime, the numbers are already growing modestly. Last year’s spring budget took the top-ups to £11bn over the five years to 2028, or put it another way, £5.8bn to 2024/2025. But adjust for inflation and it’s only £1.1bn to 2024/2025, all of it for buying big ticket items. Spending on actual day-to-day defence stuff will continue to fall.

Regional balance

For its size, the North East does well from defence spending – about £6 per head of population, way above London and the South East. This compares to £1 in Yorkshire and the North West, a little below London and the South East.

The imbalance tips the other way if you look at jobs. On this measure, the North West is the winner, with 590 direct MOD-linked jobs per 100,000 employed. Yorkshire is 120, and the North East 100. But all Northern regions are also-rans compared with the huge concentration of military jobs in the South East (Aldershot, home of the Army) and the South West (Portsmouth, home of the Royal Navy).

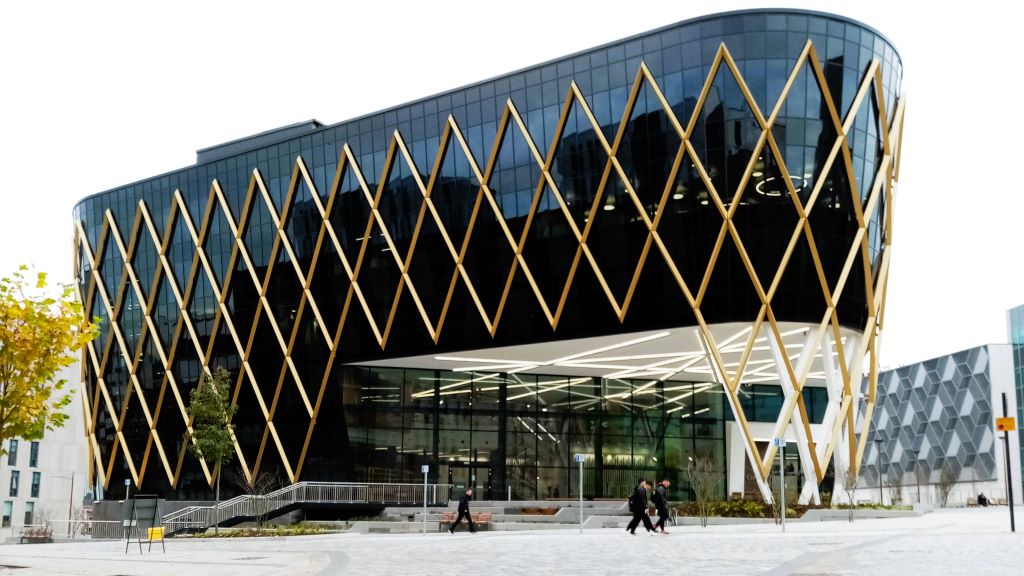

Recently announced investment includes an 807,300 sq ft distribution centre in Longtown in Cumbria, due for completion in October, and a £5bn National Cyber Force digital warfare centre for the 120-acre enterprise zone at Samlesbury in South Ribble. Projections of 3,000 staff could mean 200,000+ sq ft of office floorspace at the site. You can keep your eye out for the planning application on South Ribble Council’s planning portal, the postcode to search for is BB2 7LB.

It’s about office jobs…

There are also indirect jobs to take into account – MOD contractors and so on – and this is where property people need to pay attention. That’s because while the big growth area is aircraft and spacecraft, up 27% last year, it doesn’t amount to much (the sector accounts for about 1,000 MOD-related jobs all told). Developers may be surprised to know that by far the largest spin-offs are office jobs: about half the 79,000 indirect jobs. So it’s a good bet that this is where the largest and fastest growth will be found if defence spending goes up.

… and surplus land

What about MOD land sales? Surplus MOD land has been a substantial source of plots for housebuilders and, if it’s near ports and motorways, for industrial developers. Does a rise in MOD activity mean fewer or more sell-offs as the UK defence business focuses on its urgent new priorities? The recent trend has clearly been to sell-off, with the MOD shedding 1,400 acres in 2021/2022 and another 480 acres in 2022/2023.

Current projects include the former RAF Sealand in Deeside, where Commercial Development Projects is at work on a 493,000 sq ft warehouse, part of a 2.4m sq ft masterplan. With a following wind, a 1,050-acre former Royal Navy arms dump in Cumbria will be redeveloped for housing, although it’ll be interesting to see how they explain that on the sales particulars.

More to come, apparently

The current policy direction points firmly towards yet more sales – lots of them. The Government Property Agency has a work stream called Defence Estates Optimisation, which means spending about £4.3bn on rejigging what goes where in the hopes of cutting the defence estate by 16% before 2040/2041. That implies off-loading 54m sq ft of floorspace and who knows how much land. One might reasonably ask if this is a target that won’t survive the first whiff of cordite.

Perhaps also bear in mind that the MOD is deeply dysfunctional in a way that, given its importance, truly chills the soul. Today it is preparing to buy back a huge volume of service housing it sold in 1996 having lost as much as £4bn on the deal. Talks are underway with Annington Homes.

Conscription changes everything

Most of the land the MOD has off-loaded is described in official paperwork as training areas and ranges, so mostly land-based stuff. If the Army stops shrinking then presumably they won’t want or need to sell off so much land. Plus, of course, there’s talk of conscription, talk boosted by input from no less a person than the head of the Army. Presumably, secretary of state Grant Schapps knew he was going to say this, and it’s not idle chatter, so this is either pitch-rolling for something really frightening, or a dramatic campaign by the MOD for troop numbers to rise.

Watch the Army

But it’s not happening yet. In January 2023, the army totalled 75,710 full-time troops, down 2.2% compared with the previous year, and heading towards a target of 72,500 by 2025. If the Army grows, then the likely total would be close to 82,000, a number reached by a national security review in 2015. So far – despite generals dropping hints – the invasion of Ukraine and escalating tensions haven’t changed thinking. Growing the army reserve from 31,000 to something approaching 100,000 is more likely, but that too will need land.

Careless talk costs lives

Everything’s a bit hazy but a few hesitant conclusions are possible. First, looking at the National Cyber Centre plan and the employment statistics, the office market will probably be a significant growth area if MOD spending increases. Warehousing is also worth watching. Second, the impulse to sell off “surplus” land was coming under political pressure before Putin and Ukraine raised their heads – see the service housing catastrophe. Now it faces even more hurdles. Might we see a cooler approach to land sales in the next few years? The MOD is a policy-to-execution black hole, so what comes out of the end of this process is anyone’s guess. Meantime, don’t have nightmares.

ELEVATOR PITCH

ELEVATOR PITCH

Going up, going down. This week’s movers

The government thinks it’s a good week for freeports, and maybe it’s also a good week for Liverpool’s stalled development sites. Doors closing.

Liverpool

Liverpool

Encouraging news from Liverpool, where the city council is trying to buy one of several stalled development schemes. The New Chinatown residential, offices, and leisure development at Great George Street was launched in 2015, and has limped along ever since. The original plan was for 800 apartments, a hotel, and 120,000 sq ft of offices. Since, it has shrunk to 446 apartments and 100,000 sq ft of offices. Various changes of developer have enlivened the last nine years; substantial work on site has not.

The city council hasn’t got this in the bag yet – Ascot Group, which owns debt on part of the site, is also interested. Even so, it’s an interesting change of pace in a council which – as readers of Place North West’s below-the-line comments will know – has enjoyed mixed reviews in the property business. One of the problems has been a set-up – social, political, cultural – which discourages the well-funded, big-name developers who can deliver workable schemes. Does New Chinatown mean the city council has got the message? It’ll be interesting to see what comes next.

Freeports

Freeports

A discreet data drop from the government offers an update on investment so far in the North’s three functioning freeports. The Humber Freeport has attracted £516m in overseas investment, Liverpool just £22m from overseas, but the big winner is Teesside which scooped £500m domestic plus £602m overseas. The government reckons this amounts over the next 20 years to 770 jobs at the Humber, a whopping 2,150 at Teesside, and alas nothing yet in Liverpool. You can take these numbers with a pinch of sea salt.

Amazing progress, particularly since Humber only launched in July 2023 and the others aren’t much older. Metsa Tissues has signed up to make loo paper in Goole and at Saltend Chemicals Park – part of the Hull East tax site – Pensana is investing more than £150m in a rare earth processing facility. Meld Energy plans to invest £180m in a green hydrogen production facility at the same site.

Teesside scooped NZT Power and its plans to create the world’s first gas-fired power station with carbon capture and storage capability. Liverpool can boast a 550,000 sq ft speculative warehouse. The XDock building is forward-funded after a deal between KKR and Mirastar.

What we don’t know, however, is how far freeport incentives made a difference in investor’s decision-making.

Get in touch with David Thame: [email protected]